|

The Real-Estate RacketIn 1945, $5,000 would buy you a pretty nice house in most parts of the USA; yet according to the Inflation Calculator, that sum would equate to $52,500 60 years later, accounting just for the government's destruction of the value of the US Dollar. If someone has for sale a nice, well-maintained 3-bedroom ranch for $52 grand, please let me know. More likely, today it would go for around $300,000. Why the difference? Over that period, that dollar-dilution or inflation rate has been almost exactly 4% a year. But if my estimate of 300/5 is correct, that rate of house-price increase is 7.06% a year, a real-money appreciation rate of over 3% a year; a rate that compares well with the real after-tax return on a bank savings account, yet you get to live in the investment! How come; why should a house grow in real value by 3% while most peoples' second largest expense--the car--loses its value by perhaps 20% a year? Both become more expensive to maintain with age, though true, the car does fall apart a lot faster than the house. But both face competition from more elegant, fashionable and better-constructed modern equivalents, so why does one asset rise in value and the other, fall? I smell government intervention. In a free market, such a thing would be very strange. Location is a big factor in real estate, so let's dispose of that first. Over a 60 year period, location may not necessarily work in favor of home-value growth. During such a long period, a newly-built house will become surrounded by other developments; something in a desirable suburb on the edge of town then may have become definitely undesirable by now. That factor could work either way, but we're talking averages here, so it's a stretch to claim that that alone would boost value by a real 3% a year. Schools are also a big factor that agents stress to potential buyers, though that is really sick. They speak of government schools, of course. It's a fact that some are less damaging to children than others, so parents like to live in areas served by the better ones, and that helps boost house prices there. Government promotes a myth that what they call "education" is free in America ; these facts prove it is no such thing. A school better than average requires the purchase of a house more expensive than average, and that difference compares to the whole fee charged by a for-profit school in a free-market society. I'm not sure that the relative reputations of government schools can raise the price of all homes, but it sure does skew them. Taxes come next; the local seigneurs rip thousands of dollars a year from the "owners" of real estate and the lower that ripoff, the less impediment to purchase and so the higher the likely price of the property. There is of course no suggestion here that residents should somehow be given a free ride; if they demand and consume services such as road maintenance they should certainly pay for them. But the opposite is also true; no use, no pay. A free market provides exactly that equation. Government taxes do not. The reason why not has little to do with the alleged difficulties of pricing and charging and plenty to do with the desire of the tin gods in Town Hall to preserve their status as local rulers. Incidentally, the existence of property taxes proves on its own that property ownership is a myth. Try not paying them, and see how long you remain an "owner." But I digress; the next factor affecting home values is the interest rate charged on the loan most people have to take out to acquire somewhere to live. In a free market society, money would of course cost money; the interest rate would not be zero. However, it would most likely be far more stable than in the last century or so, and probably around 3%; the manipulation of rates to suit political demands of the moment, which is done openly and even proudly by the FedGov's lapdogs in the Federal Reserve, would not occur. Nor of course would the inflation rate, to which interest must be related; the two combine to make loan costs both high and unstable, so adding to the hazards of home buying, and contributing to an artificial boost to prices, given that demand is hard to affect--everyone has to be somewhere. Associated with the interest is of course the mortgage itself, and thanks to the magic of easy government money, those are not hard to get. Your local friendly bank seldom funds it with its depositors' money, it plucks nine times those deposits from the shell-game of Fractional Reserve Banking, or else merely sells the note to a buyer ultimately financed by the Feds. The supply of mortgage money is therefore elastic; in a free market it would, rationally, be no more elastic than a bar of gold and therefore mortgages would be harder to get, and therefore home prices would be lower. Next we must consider tax deductions, for they are a big factor in the cost calculations. For the purpose of acquiring votes, Pols have since forever "allowed" home buyers to keep some of their own money provided they spend it to service a loan from a bank they license; and that's quite a big deal, especially at the start of the loan's life, when eager young buyers may not be earning too much. A mortgage expense of $2,000/mo may consist largely of interest at that time, and that interest is tax-deductible, so there are several hundreds a month available to buy more house--or at least, to pay more for it. A market distortion, in favor of home buyers--who not only gratefully vote for the Pols who so graciously designed it, but have even been heard to oppose such "tax reform" as might eliminate these deductions. The Pols were not as generous as those voters may suppose. This deduction gives a powerful incentive to buy rather than to rent, and once the resident has a stake in the property, the Pol has hooked him into the income tax system. Should he ever resist it, he will swiftly realize he is firmly anchored by his real-estate; for that can be forfeit if he declines to pay. Oh, what a complex web they weave, when first they practice to deceive.

Zoning artificially restricts the housing industry, by political power--and alas, alack, it is by no means unpopular! Any proposed construction by the alleged owner of a nearby property, which might adversely affect the value of one's own, is likely to be the object of bitchiness and catfighting never seen elsewhere in a refined town of good neighbors. The fiction is that when one owns a home, one somehow also owns its view, its environs. That's actually false on two levels; as shown above, nobody actually owns even their own home--but certainly, there is no pretense on the contract that anyone owns anything outside the property line. But through the political magic of zoning, control over the latter is exercised nonetheless, and in a very ugly fashion. The end result: land use is restricted and manipulated as part of the political instead of the market arena; the price of building land is thereby boosted, and with it the price of housing is elevated way above its free-market level. And the devil of it all is that homeowners are happy with the whole scheme! They are sitting in a gold mine! They are bombarded with offers of low-cost home-equity loans with which to buy Escalades and world cruises and every luxury modern man might desire; this massive housing bubble is created and sustained by politicking and actually brings large tangible benefit! Can all this be anything less than the American Dream, fulfilled before our eyes? Well, yes it can. That dream is about universally available ownership, of home and other property; but as shown, no such ownership actually exists, so nor does any such fulfillment. And the cost of the illusion that has been fulfilled is that property pseudo-owners are locked up tightly with the entire political system: taxes local and national, and all the evil they purchase; the funny-money, government-controlled banking cartel; and even schools with which to indoctrinate yet another generation. And that's the American Nightmare. |

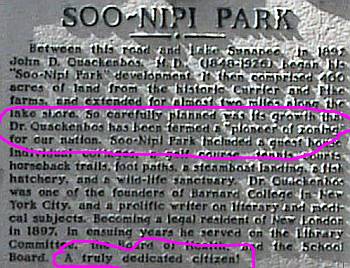

Lastly let's not forget zoning. Those aforementioned tin gods decree what can and cannot be built, and where; another proof, were any needed, that property ownership is a myth. There's a roadside marker not two miles from my (rented) home, celebrating the place where zoning was invented; I regret the proximity, but plead that it was all done long before my time.

Lastly let's not forget zoning. Those aforementioned tin gods decree what can and cannot be built, and where; another proof, were any needed, that property ownership is a myth. There's a roadside marker not two miles from my (rented) home, celebrating the place where zoning was invented; I regret the proximity, but plead that it was all done long before my time.