|

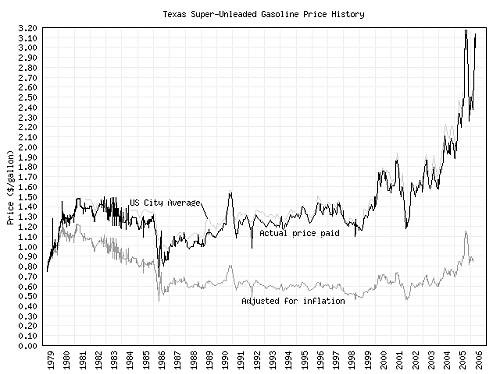

What Gas Crunch?Many regular readers of STR will also have read Rothbard's masterpiece, What Has Government Done to Our Money? (Can anyone tell me where to find my copy? It walked off my bookshelf!) and will therefore be taking the current hype about gasoline prices with a large pinch of salt. Superficially, of course, they are ten times where they were half a century ago; and thanks to the training delivered in government schools, a superficial look is all it usually gets. On this sky-is-falling basis, I have actually heard some in the media tell us "The market is working; the high oil prices are stimulating development of alternative fuels!"--just as if the newscaster understood what a "market" is. And sure enough, proof is at hand; on May 7th, CBS' "60 Minutes," no less, took its audience to Iowa to meet a group of farmers who have, during the last few years, pooled their savings and built a factory to turn their corn into ethanol. They are doing so well they are about to double its size. The alternatives include that fuel, and biodiesel from soybeans, and good luck to them both; as well as the old familiar coal, hydro, wind and nuclear; the latter has had a really rough break from the eco-freaks, for it is probably the safest of the lot. "Hydrogen" and hybrid cars are favored in PC circles; the Toyota Prius has received from them a heap more praise than it deserves. I drove one for a couple of weeks, and it's an ugly vehicle with little cabin space and does not deliver 60 MPG city, or even highway; or not if one treats government speed limits with even slight contempt. Then of course there are the enormous oil fields waiting to be exploited in ANWR and under the outer US continental shelf, as soon as Nanny gives permission in D.C. There is no energy shortage at all, given time for development and the normal market stimuli of higher prices; and the "time" element is more political than logistical. But wait: Are we quite sure those stimulating high prices have arrived? I surfed the Net and found a splendidly useful site called randomuseless.info on which a kindly Texan had posted news of every price he paid at the pump during the last 27 years. Here's his graph:

The two upper lines are easy to recognize, but the lower is the one that matters. This adjusts prices for the government's devastation of its "dollar" and by running the eye across the chart from 1979 to the present, it's easy to see that the real price of gas is almost identical today to what it was 27 years ago; and that for most of the years in between, it was lower. Further, for the 20 years from 1981 to 2001, prices fell, gradually but rather uniformly in those real terms! True, after a group of radical Muslims, outraged by six decades of US Government support for its enemy the State of Israel, took a terrible revenge in 2001 and the Feds responded by invading one major oil producer and menacing another, real gas prices have risen; from about 50 cents to 85 cents a gallon, in 1979 dollars. Gosh, whoever would have thought it? Simultaneously the Feds, who were advised a couple of centuries ago to avoid all entangling alliances but to pursue peace and honest trade with all foreigners, have also managed to fall out with other major oil producers like Nigeria and Venezuela. Gee, it's almost as if they wanted high oil prices! Why could that possibly be? There's no link, is there, between anyone in political power and any of the oil companies, now enjoying high resulting profits? But let us suppose that in the next year or three, there is a withdrawal from Iraq and a patching up of relations with Iran and even some of the other producer nations. It might happen, you never know; voters are angry about pump prices and could cause the Dems to break the Reps' monopoly on power this November, and a divided government is always slightly less dangerous than an united one. So let's hope, and let's suppose. Likely result: lower prices, even though an emerging middle class in both India and China is said to be steadily raising demand for the black stuff. Perhaps prices will fall back in real terms to where they were in 2000. In that case, what will happen to all that alleged stimulus for alternative energy sources? And how will Toyota sell all those surplus Prii, nicely subsidized though they are by taxpayer money? Those questions require prediction, and prediction is not at all as easy for the future as it is for the past; but even so, I'll try. I could be wrong, but I've been underwhelmed by any rush to develop alternative energy sources and the reason, I think, is plain in the graph above: The stimulus of rising prices is illusory, absent. However, that stimulus is not the only factor in play: another, equally important, is the falling cost of those alternatives. Sorry, but I have no handy-dandy chart to prove this, but I think the real cost of providing a unit of power cleanly from coal and solar and nukes and corn and soybeans and even wind and tide may be gradually falling, perhaps faster than that of extracting oil. If so, a slow but steady transfer to some of them is not only probable but certain, thanks to the inexorable long-run operation of the market. I think the next quarter century will see a transfer to better and abundant power sources, any oily affiliations in Washington notwithstanding. I doubt that it's quite time to dust off that bicycle. |