|

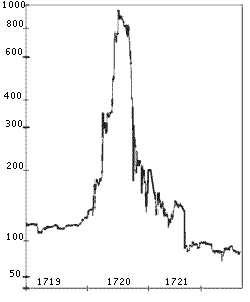

The BubbleIt's the name given to a chart of price movement that shows a very large rise, followed by a very large fall; its shape is more or less symmetrical, like the one shown here representing the price of shares in the South Sea Company around 1720 and denominated in pounds. As it shows, the price rose briefly by a factor of nine. This South Sea Bubble is the granddaddy of them all, and my interest in it was piqued after reading Robert Goddard's novel, Sea Change. Goddard has become my favorite modern fiction author. So I checked Wikipedia for more, and stumbled over terms that are, for me, tough to grasp. Central to the story is that George I's government owed various creditors some £30 million, at a time when his country had a GDP of £64 million, hence, it was in the hole for 47% of the national product. Dreadful, but only half as bad as today's US Government's debt which is around 100%. The trick in 1720 was that this “national debt” was “converted” into shares in the South Sea Co. The bit that fogged my brain was the word “converted.” Wiki's account of the fiasco stresses malfeasance by prominent Brits of the time, and the suffering and ruin of the many investors affected by the price collapse. But the core of the story is that word “convert.” What exactly was going on here; what was His Majesty's Government up to? And did it set an example or precedent for today's governments? South Sea Co. was founded in 1711, with the twin objectives of operating a monopoly trade with South America, and (!) reducing the national debt. The former was a bit tricky because aside from Brazil, South American ports were all controlled by Spain, and Spain and Britain were in the middle of a war, which lasted until 1714; so that second objective took precedence from the start. The idea was that those who had loaned money to the government were to be required by law to exchange their notes (T-bills would be today's equivalent) for shares in South Sea. Thus, the government's debt would shrink to zero, while its creditors could look forward to accelerated repayments on their loans, in the form of dividends from the new company with its rich prospects for monopoly trading. Everyone a winner, almost guaranteed. Stripped of and translated from the inevitable governmental obfuscation, the Chancellor's letter to its bondholders might have explained the “conversion” something like this: “Dear Creditor, thank you again for lending us money by buying some of our bonds. As you know, they say we'll pay you back your money after ten years, with interest. We intended to get the money for that by stealing it from taxpayers, and you knew that when you bought the bonds, but never mind; if you don't tell, we won't either.

“This is to announce that we've changed our minds. Instead of paying you cash then, we are canceling your bonds now and giving you in their place shares in the South Sea Company, which we chartered and equipped with a trading monopoly, and your share certificate is enclosed with a par value equivalent to your loan to us. This new arrangement has several advantages. “First, if you wish, you can sell your shares at once and take the cash. Or you can wait and sell them later, after their price has risen on the market as a result of South Sea's expected lucrative trade with companies in South America. Waiting should bring you a much bigger return, and of course you'll have its dividends in the meantime. “Second, it means we the government don't have to rob anyone in order to pay you back what you loaned to us. Our 'national debt' is discharged immediately. “Some have asked whether they have a choice, and of course the answer is 'no'. We are the government so we make the rules; if we sign contracts like the one in the bonds you bought, we decide whether, how and when they will be honoured. Those who are not satisfied can always sue us, with our sovereign permission, in one of our courts. “Enjoy your share certificates, spend responsibly, and have a good day. “Very truly yours, John Aislabie, H.M. Chancellor of the Exchequer.” South Sea Co promoters got busy in a couple of ways: They slipped generous packages of shares to members of the two houses of parliament in exchange for their support in the various bills that needed passing for this scheme to come into effect, as well as to others with large influence in high places. Then secondly, when the share price began to rise, they sold them actively to the investing public, so causing the rise to accelerate. Actual trading across the Atlantic was not aggressively pursued, except to ferry a few slaves from Africa to South America. There were few actual trading profits; substance was seriously lacking. But with a government monopoly like the fabulous East India Company had, how could it go wrong? This was “mercantilism”, against which Adam Smith inveighed half a century later, at its most fruitful and most corrupt. “The best laid plans of mice and men gang oft agley,” wrote Burns, but he did it 60 years after this event, so perhaps in 1720, nobody knew that. They'd found out, though, by 1721. In the Fall of 1720, there was so much selling, by those who had been bribed with shares, that investors belatedly took a more careful look at the source of South Sea's projected profits and didn't find one, and they heard from Paris of the abject failure of a comparable program in France called the Mississippi Scheme, and panic set in and the bubble burst. Success has many fathers, but failure is an orphan, and when the collapse gathered pace, the knives came out and culprits were sought. There were plenty, and with great pomp the government (which had designed the scheme from the get-go) indignantly held committees of enquiry to find out whom to blame. Bribe-takers ran for cover. People rioted. A few were caged, others heavily fined. Chancellor Aislabie was imprisoned in the Tower of London for the "most notorious, dangerous and infamous corruption.” The elderly father of calculus Sir Isaac Newton remarked of it all that he “could not calculate the madness of people.” There, in my view, Newton missed the point. It's true that speculative fever played a big part in the fiasco, but the real moral of the tale is the wickedness not so much of the bribers or bribe takers but of the government which voted to get itself off the hook of indebtedness by chartering a fraudulent, phantom scheme. It “converted” obligations to its creditors by compelling them to invest in a venture without substance. For that matter, of course, government itself is no more than a venture without substance. In passing, it's worth noting that this wicked manipulation of money took place three centuries ago, and two centuries before government invented fiat, paper money. Such malfeasance did not begin with the Federal Reserve Act; the Fed magnifies the problem, but its source is not any group of bankers, but government itself. Cheating on the currency goes back at least as far as the Roman Empire. Will modern governments concoct schemes like South Sea, to solve their debt problems? Stay tuned, but I suppose not; that one is too infamous to be reused. But there are now many with debt-to-GDP ratios far worse than the Brits had in 1720. The FedGov is listed at 102%, Greece at 163%, even conservative Singapore is at 100%, and Japan at an incredible 230%. Such debts cannot be retired by taxation if and when realistic interest rates (say, 3% plus inflation) are restored. The Feds have $14 trillion to handle, and if their total grab is $3 trillion a year and the interest rate were 4%, any mortgage calculator will show that for a (say) 30-year pay down, they'd have to spend over $0.8T a year, or a quarter of their total revenue. Taxpaying voters are a complacent, long-suffering lot, but that's something up with which I don't think they will put. The Greek and Japanese situations are of course far worse yet. So what tricks will governments pull, to unburden themselves of the results of their past profligacy? The latest is the one that turned an island into a verb: they may Cyprus those who leave money in banks. Also, honored by frequent use is to Weimarize (or Zimbabwify) their currencies, making them worth so little that it's easy to pay off debts of a few trillion. Or, they might try imposing a 2% national property tax for 30 years. All such tricks come with some awesome adverse consequences. They really are up a creek without any paddle so far visible, I'm happy to say. The lesson for all is very clear: If anyone has wealth to store, keep it far distant from any third party controlled by government (including but not limited to banks) and in a form beyond its power to inflate. Borrow or accept from quasi-government and government sources as much as one may wish, but never pay or lend to them one red cent more than is unavoidable. Well hidden gold and silver coins are clear choices, and Bitcoin makes an interesting alternative. Much better yet is to take rational action to terminate the whole miserable existence of government, and thereby eliminate the trickster. Meanwhile, abrogation of these monstrous debts is the correct course, and the result would be that no sane person would ever again lend money to the government which announced it; and that outcome would be highly desirable. Because it's the right thing to do, we can be rather sure that governments won't do it. |